Financing

Care Credit

Learn how to apply for care credit’s financing

Choose $0 deposit with 0% interest for 18 or 24 months

Learn More

Alphaeon

Learn how to apply for alpheon financing

You can choose various financing terms to make paying for your surgery much easier. SSN or ITIN qualifies

Learn More

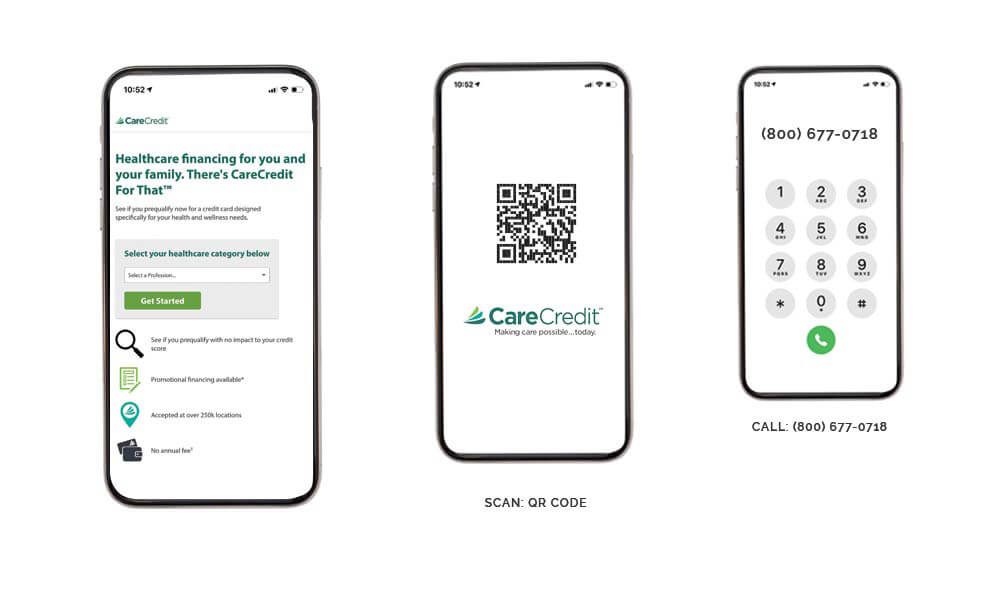

CareCredit

As a service to our patients, we are pleased to offer the CareCredit card, the nation’s leading patient payment program. CareCredit lets you begin your procedure immediately — then pay for it over time with monthly payments that fit easily into your monthly budget. CareCredit can help you see clearer, sooner.

For vision procedures, CareCredit offers

- Easy application process with instant decision

- Accepted at any of our 7+ locations

- A soft inquiry, which won’t impact your credit bureau source

- No annual fee

To apply for CareCredit now, click on your location below!

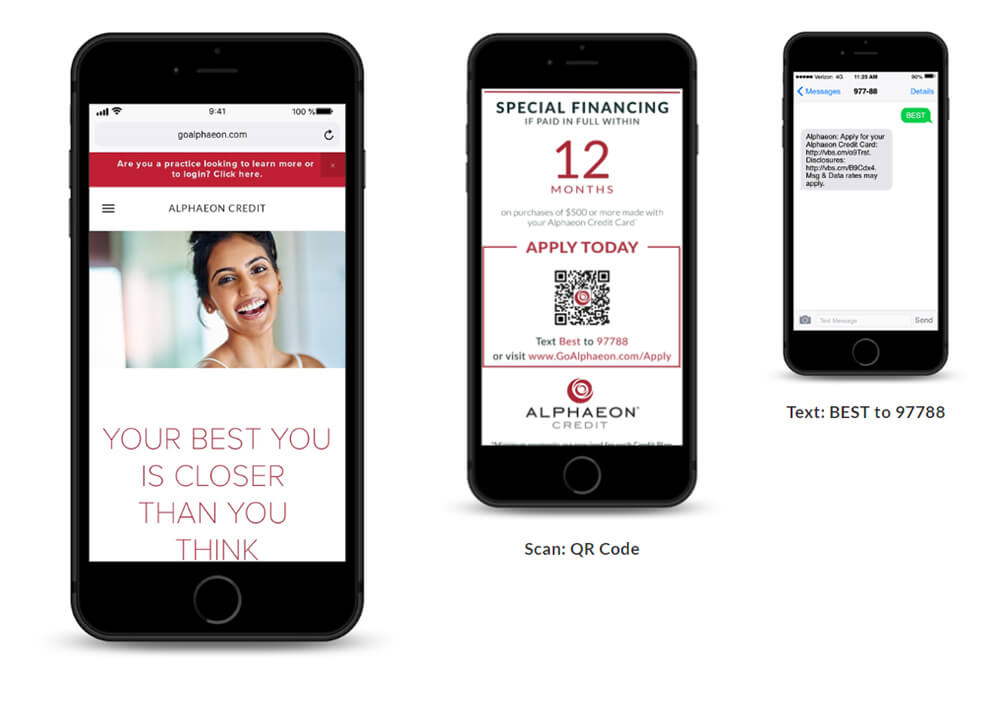

Alphaeon

With the ALPHAEON CREDIT card, you’ll find the widest array of monthly payment options to help your reach your individual wellness, beauty, and performance goals without delay. Plus, Alpheon offers special financing options

For vision procedures, Alpheon offers

- Online application with instant approvals

- 0% interest if paid in full within 6, 12, 18, or 24 months

- Accepted at any of our 7+ locations

- No hidden fees or pre-payment penalties

To Qualify, patients can either visit goalpheon.com/apply, or scan the following QR codes, or text BEST to 97788.

What is a Flexible Savings Account?

A Flexible Savings Account (or FSA) is a tax-advantaged savings account that helps you save for medical costs, including vision correction procedures like LASIK that insurance doesn’t cover. With an FSA, you can use it to pay for things like your co-payments, prescriptions, and other approved health expenses.

You can only have an FSA if it’s included as part of a benefits package from your employer. The funds in your flexible spending account are pre-taxed, meaning you’ll contribute to your FSA with each paycheck.

If you don’t use the funds in your flexible spending account, you’ll lose them when the new year begins. In rare circumstances, your employer may give you a rollover or grace period (about two months) into the new year to use up your flex spending dollars.

What is a Health Savings Account?

A Health Savings Account (or HSA) is only available to people with a high-deductible health plan (HDHP). Like an FSA, contributions to an HSA are also pre-taxed, meaning you can deduct the year’s contributions from your taxes when you file. You can use funds from a health savings account to help pay for procedures like LASIK.

Unlike an FSA, funds in an HSA can roll over into the following year, allowing you to save more money for medical expenses. However, you must qualify for an HSA with an HDHP insurance plan. Employers can also contribute to your HSA, similar to how they would contribute to a 401(k) as part of your benefits plan. There is a contribution limit with HSAs, but the limit is higher than with FSAs.